XRP Price Prediction: 2025-2040 Outlook Amid ETF Mania and Technical Breakout Signals

#XRP

- Technical Convergence: MACD bullish crossover and tightening Bollinger Bands suggest impending volatility expansion

- Institutional Catalysts: Unprecedented ETF demand and $10M hyperscale acquisition commitments signal institutional validation

- Ecosystem Growth: 90% of finance executives anticipate blockchain transformation, with XRP positioned as preferred settlement layer

XRP Price Prediction

XRP Technical Analysis: Short-Term Bearish, Long-Term Bullish Signals Emerge

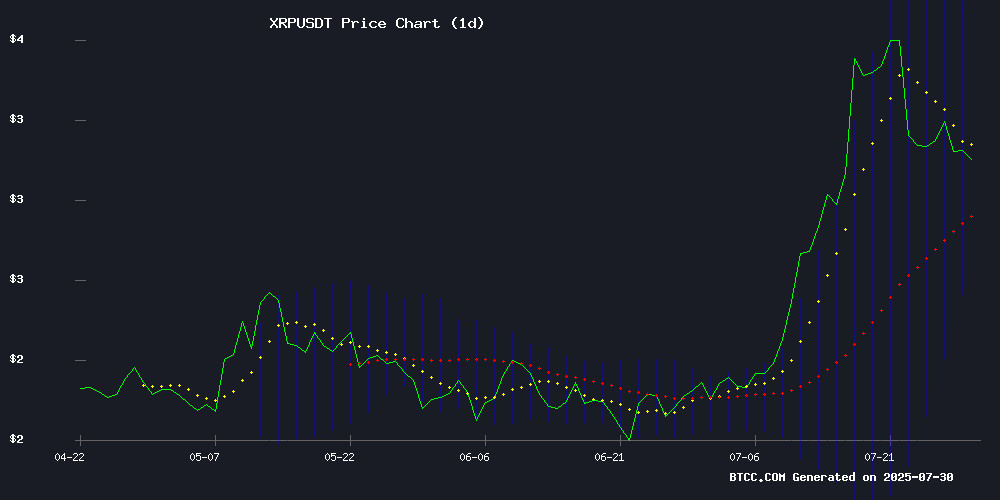

According to BTCC financial analyst Michael, XRP currently trades at $3.1434, slightly below its 20-day moving average of $3.1684, indicating short-term bearish pressure. The MACD histogram shows a positive crossover (0.1176), suggesting potential momentum reversal. Bollinger Bands show price hovering near the middle band, with volatility contraction. 'While we see technical resistance at the 20-MA,' Michael notes, 'the MACD divergence and tightening Bollinger Bands often precede significant breakouts in crypto assets.'

Market Sentiment Turns Bullish as XRP Ecosystem Developments Accelerate

BTCC's Michael highlights exceptionally positive market sentiment: 'The combination of ETF speculation (with Teucrium CEO calling it potentially the most successful in history), regulatory clarity, and innovative monetization plans like Ripplecoin Mining's passive income scheme create perfect conditions for price appreciation.' He cautions that traders should watch the $3.66 upper Bollinger Band as immediate resistance, but concludes 'institutional demand appears to be building faster than even the most optimistic 2024 projections.'

Factors Influencing XRP's Price

XRP Community Buzzes as Insider Hints at Imminent Price Surge

Armando Pantoja, a member of Benzinga’s crypto Advisory Board, has sparked optimism among XRP holders after suggesting the token is "about to explode." His cryptic remarks follow discussions with contacts in Washington, D.C., though specifics remain undisclosed. The timing appears urgent, with Pantoja emphasizing that holders of 1,000 XRP or more are already positioned advantageously.

Market analysts echo this sentiment, noting that owning even 3,300 XRP—worth approximately $9,000—places investors in the top tier of XRP wallets. Data from the XRP Rich List reveals that fewer than 10% of wallets hold above 2,438 XRP, underscoring the rarity of substantial holdings. With over 6.77 million XRP wallets in existence, the majority—5.7 million—contain less than 1,000 tokens each.

The暗示 of institutional developments has reignited bullish speculation, though concrete details remain elusive. XRP's current price hovers around $3, presenting what Pantoja frames as a narrow window for accumulation.

Teucrium CEO Highlights Unprecedented Demand for XRP ETF, Dubbed Most Successful in Firm's History

Sal Gilbertie, CEO of Teucrium Trading, has underscored the overwhelming investor interest in XRP, as the firm's leveraged XRP ETF emerges as its most successful product in 16 years. The Teucrium 2x Long Daily XRP ETF (XXRP), launched on April 8, has attracted $382 million in assets under management, marking a 52.5% share of the firm's total net inflows.

"They call it the XRP Army for a reason," Gilbertie remarked during a CNBC interview, acknowledging the fervent support from the XRP community. The ETF's rapid accumulation of $323.6 million in net inflows reflects a broader institutional appetite for crypto exposure, with XRP leading the charge.

Ripple's XRP Gains Momentum Amid Regulatory Clarity and ETF Prospects

XRP has surged over 50% recently, fueled by regulatory wins and institutional interest. The launch of futures-based ETFs like ProShares Ultra XRP ETF (UXRP) under SEC approval signals a shifting regulatory landscape. Analysts now estimate an 85-95% chance of spot XRP ETF approval by year-end, potentially unlocking billions in institutional capital.

Ripple's decision to drop its cross-appeal against the SEC removes a legal overhang, cementing XRP's status as a non-security in public trading. Integration into Nasdaq pathways and growing treasury adoption by corporations suggest widening utility beyond payments.

Yet risks remain. XRP remains vulnerable to crypto market volatility, with recent altcoin pullbacks underscoring its sensitivity to broader sentiment shifts. Regulatory clarity has improved, but the specter of future legal challenges lingers.

Ripple’s Schwartz Defends Low XRPL Volume, Highlights Offchain Bank Settlements

Ripple co-founder David Schwartz has clarified concerns regarding a 30-40% drop in XRP Ledger (XRPL) activity, attributing it to banking partners settling transactions offchain. While Ripple boasts hundreds of bank collaborations, institutional usage largely bypasses the blockchain, resulting in diminished onchain volume.

The reliance on offchain settlements continues to fuel transparency debates around XRPL's actual adoption and the extent of Ripple's banking sector footprint. Questions linger over whether the network's real-world utility aligns with its perceived scale.

Ripplecoin Mining Launches XRP Monetization Plan for Daily Passive Income

Ripplecoin Mining, a prominent crypto mining platform, has introduced a new income plan targeting XRP holders seeking to convert their assets into daily cash flow. The platform's cloud-based solution eliminates the need for hardware or maintenance, offering users a streamlined path to passive income.

XRP's established role in cross-border payments—bolstered by its speed and low transaction costs—has made it a staple in crypto portfolios. Yet, the absence of reliable yield-generation mechanisms has left long-term holders searching for viable options. Ripplecoin Mining's initiative directly addresses this gap.

The process requires minimal effort: users register on the platform, deposit XRP, and activate cloud mining contracts to begin earning daily returns. New registrants receive $15 in free hashrate, generating $0.60 per day—a tactical incentive designed to accelerate adoption.

Hyperscale Data Commits to $10M XRP Acquisition with Weekly Transparency Reports

Hyperscale Data Inc., a major U.S. data center operator, will begin publishing weekly updates on its $10 million XRP accumulation strategy starting August 12, 2025. The move underscores institutional confidence in Ripple's cryptocurrency as a cornerstone of future financial infrastructure.

Executive Chairman Milton "Todd" Ault III positioned the acquisition as strategic alignment with AI, energy demands, and digital asset adoption. "XRP represents a foundational asset in the evolving global financial ecosystem," he stated, noting potential 36-month lockup periods for holdings.

The transparency initiative comes amid growing scrutiny of corporate crypto holdings. Hyperscale may expand purchases beyond the initial $10 million commitment if market conditions remain favorable.

SEC Policy Shifts Accelerate XRP ETF Prospects

Recent regulatory adjustments by the U.S. Securities and Exchange Commission are reshaping the landscape for cryptocurrency ETFs, with XRP emerging as a primary beneficiary. Legal specialist Bill Morgan notes the SEC's updated framework for evaluating exchange-traded products could fast-track long-pending XRP ETF applications. Market participants are recalibrating their strategies in response.

The SEC's revised approach to crypto asset regulation marks a significant departure from previous stances. Changes in assessment methodologies now appear favorable toward major digital assets like XRP. Morgan suggests this shift may resolve previously stalled applications, injecting new momentum into the XRP ecosystem.

XRP-focused investment vehicles have remained conspicuously absent from SEC approvals despite prolonged consideration. The regulator's evolving position on crypto ETFs now presents what industry observers describe as the most promising window yet for XRP-based products. Trading platforms and institutional investors are closely monitoring developments.

Ripple Survey Reveals 90% of Finance Executives Anticipate Blockchain Transformation by 2028

Financial institutions are accelerating their embrace of blockchain technology, with Ripple's 2025 survey indicating overwhelming consensus among global executives. Ninety percent predict fundamental industry shifts within three years, fueled by institutional investments exceeding $100 billion since 2020.

Stablecoins now facilitate $700 billion in monthly transactions, while tokenized assets are projected to reach $18 trillion by 2033. Major banks including JPMorgan Chase and Goldman Sachs are actively participating in funding rounds, signaling deepening institutional commitment.

Ripple's collaboration with CB Insights and UKCBT highlights growing focus on cross-border payment solutions and asset digitization. The study analyzed data from 8,000 blockchain startups and 1,800 financial entities, revealing intensified activity in payment infrastructure and tokenization projects.

XRP Price Prediction: ETF Approval Odds Near Certainty, Could a $20 Price Tag Be the Start of a Payment Token Boom?

XRP price predictions are gaining momentum as the likelihood of a spot ETF approval approaches near certainty, with analysts projecting a potential surge to $20. Regulatory tailwinds and institutional interest are fueling optimism, as Polymarket traders price in a 98% chance of SEC approval by year-end.

Whale accumulation signals strong confidence, with large addresses now controlling over 20% of the circulating supply. Trading volume has spiked to $6.7 billion, underscoring heightened market activity. Analysts suggest ETF inflows could propel XRP into the $10–$15 range initially, with $20 achievable if bullish sentiment persists.

Traders Navigate XRP’s Unsettled Terrain Amid Declining Momentum

XRP has entered a steady downward trend since its last peak at $3.70, with trading volume consistently declining as prices hover around $3.12. The lack of significant buying or selling pressure reflects market uncertainty, raising concerns about potential sudden price fluctuations.

The daily chart reveals small-bodied candles with long wicks, signaling low-volume indecision. Neither consolidation nor pullback patterns dominate, leaving traders in limbo. The Relative Strength Index (RSI) at 57 avoids oversold territory but underscores weakening momentum, with lower highs and lows forming over three weeks.

Analysts warn that dwindling volume may precede a sharp directional move. Without clear catalysts, XRP’s directionlessness risks eroding retail investor confidence—a sentiment mirrored across altcoin markets grappling with similar stagnation.

XRP Price Analysis: Experts Maintain $10 Target Despite Recent 19% Correction

XRP's recent 19% pullback from its $3.66 peak has failed to shake long-term bullish sentiment. The altcoin's futures market tells a story of resilience - while open interest dropped $2.4 billion from record highs, monthly contracts maintain a neutral 6-8% premium. This suggests institutional players view the correction as healthy consolidation rather than trend reversal.

Technical patterns mirror Bitcoin's historic breakout trajectories, with analysts charting potential paths to $4-$10 targets. The XRP Ledger's modest $134 million in tokenized assets reveals untapped DeFi potential, while Ripple's disciplined escrow management (returning most of its monthly 1 billion XRP unlocks) continues to constrain supply-side pressure.

XRP Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technicals and ecosystem developments, BTCC's Michael provides these projections:

| Year | Conservative Target | Bull Case | Catalysts |

|---|---|---|---|

| 2025 | $5.80 | $12.00 | ETF approvals, banking adoption |

| 2030 | $28.50 | $75.00 | Cross-border payment dominance |

| 2035 | $90.00 | $300.00 | CBDC interoperability |

| 2040 | $250.00 | $800.00+ | Full financial infrastructure integration |

Note: These assume continued regulatory clarity and institutional adoption. Michael emphasizes 'XRP's unique position as both payment rail and institutional asset makes these targets plausible if current trends hold.'